Manish Jha

I am an Assistant Professor of Finance at Georgia State University. I hold a Ph.D. in Finance from Washington University and a Bachelor's degree in Technology from IIT Kanpur. Prior to my doctoral studies, I worked in sovereign bond research and options trading. I am deeply grateful for the support from Human Resource India, Kendriya Vidyalaya, MPS Foundation, and Super30. Feel free to reach out at mjha@gsu.edu or connect on LinkedIn and Twitter/X.

What's New? I will be attending the UConn Finance Conference in May and visiting Florida State University and the University of North Texas for fall seminars. Please feel free to reach out if you'd like to connect while I'm there.

Research

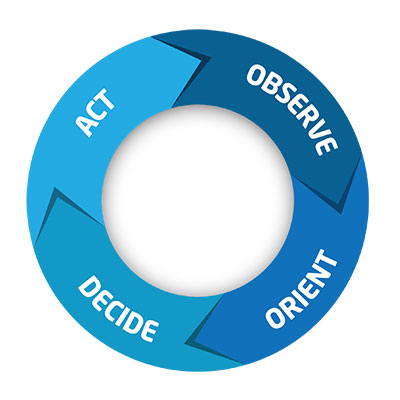

Interests: Artificial Intelligence, Corporate Governance, Financial Technology, Machine Learning, Text Analysis

Working & Revision Papers

No. 3

ChatGPT and Corporate Policies

Revise and resubmit at Management Science.

Finalist, John L. Weinberg/IRRCi Best Paper Award 2024. Second Place, Dr. Richard A. Crowell Memorial Prize 2023.

ChatGPT could predict corporate policies, sometimes better than the market and forecasters.

Finalist, John L. Weinberg/IRRCi Best Paper Award 2024. Second Place, Dr. Richard A. Crowell Memorial Prize 2023.

ChatGPT could predict corporate policies, sometimes better than the market and forecasters.

No. 2

Generative AI, Managerial Expectations, and Economic Activity

We could use generative AI to predict economic indicators.

No. 1

ESG Metrics in Executive Compensation: a Multitasking Approach

Best Working Paper, IE University's Sustainability Research Award 2025.

ESG metrics in compensation contracts are accompanied with lower performance sensitivity for financial metrics.

ESG metrics in compensation contracts are accompanied with lower performance sensitivity for financial metrics.

Published & Accepted Papers

No. 5

The Politicization of Social Responsibility

Journal of Finance, Forthcoming.

Institutions' support for socially responsible proposals varies based on state politics.

Institutions' support for socially responsible proposals varies based on state politics.

No. 3

A Shared Interest: Do Bonds Strengthen Equity Monitoring?

Journal of Financial and Quantitative Analysis, 2026.

Institutions monitor firms more when they hold firms' bonds.

Institutions monitor firms more when they hold firms' bonds.

No. 1

Natural Disaster Effects on Popular Sentiment Toward Finance

Journal of Financial and Quantitative Analysis, Vol. 56, No. 7, November 2021.

People have negative sentiment towards finance after uninsured disasters.

People have negative sentiment towards finance after uninsured disasters.

Teaching

Georgia State University

FI 8092: AI and Machine Learning Applications in Finance (2025–26)

FI 4020: Financial Analysis and Introduction to Loan Structuring (2021–25)

Washington University in St. Louis

Teaching Assistant — Empirical Methods in Finance (PhD Level, 2019)

Advanced Corporate Finance: Financing, Mergers and Acquisitions, Valuation (2017–21)

Asset Pricing: Investment Theory, Options & Futures (2017)

Resources

Data

Finance Sentiment Dataset — Sentiment toward finance in an annual panel spanning British English, Chinese, French, German, Italian, Russian, Spanish, and US English from 1870 to 2009.

Conferences

AI Revolution in Finance — April 25–26, 2025 | Atlanta

GSU-MS AI & FinTech — October 3–4, 2025 | Atlanta

Miscellaneous

EB-1B Advice — Slides on my experience with the outstanding professor visa.

Text Data in Finance — Slides from a three-hour PhD class.

Finance JM Advice — Presentation for PhD students on the 2020 finance job market experience.

Business PhD Admissions — Explains the admission process for prospective students.

Procurement Basics — Basics of refinery equipment procurement.

Media

The Politicization of Social Responsibility

[PDF]

Harvard Corporate Governance Forum · September 4, 2024

Seizing Generative AI to Forecast Economic Trends

[PDF]

Georgia State News Hub, Ground News, MSN.com, Phys.org · January 13, 2025

October 2024's Top Papers in Quant Finance, Including AI & LLM in Finance

[PDF]

ZanistaAI · November 18, 2024

LLMs can measure and identify corporate policies

[PDF]

Chicago Booth Review Fall 2024 Magazine · September 21, 2024

AI in Banking and Finance

[PDF]

Law and Technology Resources for Legal Professionals · February 29, 2024

22nd Annual Dr. RA Crowell Memorial Prize

[PDF]

AI Journal, Business Wire, PanAgora, Yahoo Singapore · February 27, 2024

Bonds Improve Institutional Investors' Equity Monitoring

[PDF]

Chicago Booth Promarket · May 10, 2023

Barking Up the Right Tree: How Shareholder Activists Raise Issues to Placate Large Mutual Funds

[PDF]

Chicago Booth Promarket · December 16, 2020

Can the Finance Industry Be Trusted This Time?

[PDF]

Bloomberg Opinion / Washington Post · August 10, 2020