Bonds Lie in the Portfolio of the Beholder

Do Bonds Affect Equity Monitoring?

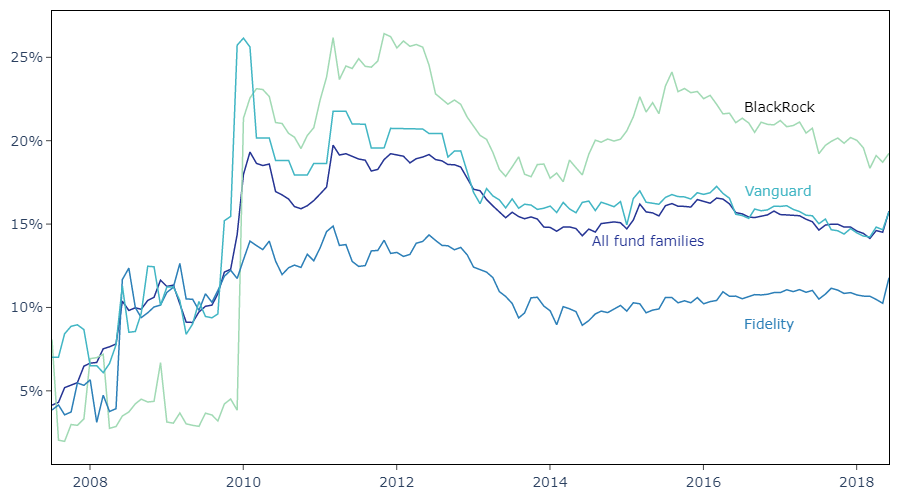

The increasingly diverse holdings of institutional investors, who hold around 70% of public US firms’ outstanding equity, raise questions about whether they actively vote their shares and monitor individual companies. For example, each of the three largest mutual fund families in terms of total net assets (Vanguard, Fidelity, and BlackRock) held equity positions in around 5,000 US companies as of December 2018, casting doubt on their ability to monitor every company in their extensive portfolios. However, recent evidence suggests these institutions are attentive owners for stocks that comprise a larger portion of their overall portfolio and that even institutions primarily holding indexed positions play an important governance role. This paper analyzes whether institutions’ large corporate bond portfolios might affect how actively they monitor and vote their shares.

Presentations

- Financial Research Association Conference 2019 (early ideas)

- Washinton University 2021

Abstract

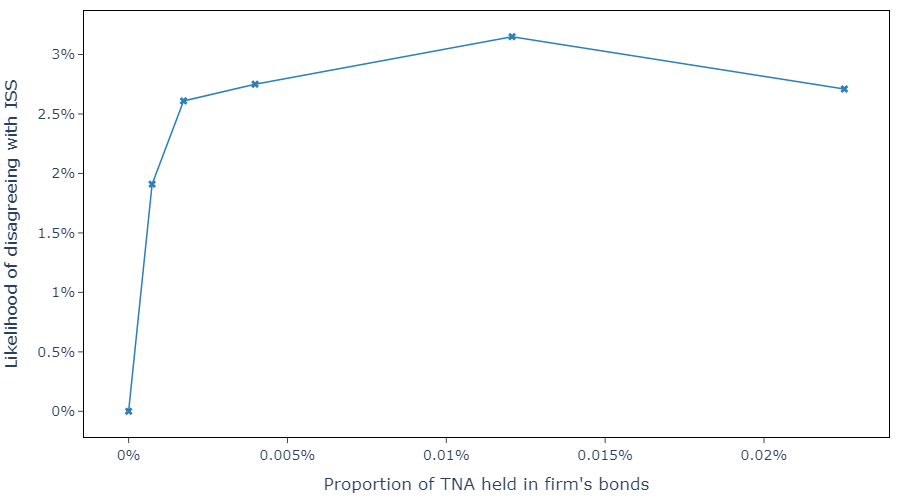

We analyze whether institutional investors’ increasingly extensive corporate bond holdings are associated with how actively institutions vote and monitor their equity investments. We find that institutions conduct more governance research and are less likely to follow proxy advisor vote recommendations for companies whose bonds represent a larger proportion of their overall portfolio. Corporate bonds held in equity-focused funds and shareholder proposals that are more likely to require investors’ attention drive these findings. There is no evidence that creditor-shareholder conflicts explain these findings. Our results suggest that institutions’ bond holdings contribute to their overall incentive to be engaged monitors.

Key Figures