Catching the conscience of kings

How Activists Pander Mutual Funds

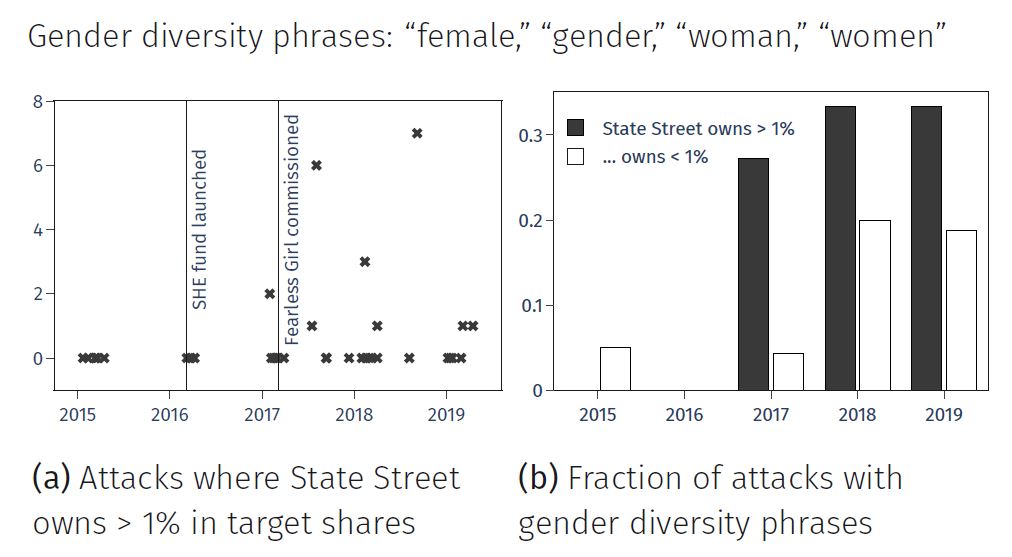

When Hamlet says, “I will catch the conscience of the king,” he is hoping that the king’s conscience will shine through when he’s watching the play that portrays a familiar murder scene (pictured above). In proxy fights, we see a similar pattern wherein the hedge fund activists try to capture the votes from mutual fund institutions (fund families) that hold larger shares in the targeted firms. Hedge funds often need other shareholders’ support to win proxy fights; they persuade these fund families by using words in their attack texts that align with families’ preferences. For example, a recent push from the fund families to broaden gender diversity on corporate boards has coincided with a shift in activists’ communications. In this paper, I examine whether activists tailor their campaigns to persuade shareholders and its impact on campaigns, tactics, and successes.

... but how do you know what these fund families want?

It does seem abstract to know what a fund family wants. However, there are ways it is revealed, such as behind the scenes engagements, voting in shareholder proposals, proxy voting guidelines. I focus on fund family voting in shareholder proposals to measure preferences. To relate voting choices with proposals’ textual features (phrases), I use a supervised machine learning model called Support Vector Regression (SVR). SVR essentially assigns a coefficient to each phrase based on how the phrases affect fund families’ decision to support activists.

For instance, during 2017-2018, DWS voted “for” in 97% of climate-related proposals, as opposed to 12% by Vanguard. Thus, a machine learning model trained on these proposals will figure out that phrases such as “climate change,” “environmental concerns,” etc., are important for DWS, compared to Vanguard. Subsequently, an attack which focuses on environmental issues could be considered more aligned with DWS preferences, and will likely get more activist support from DWS.

Do activists pander more to some shareholders?

I find that activists focus on the preferences of fund families that own more shares in the target when designing their attack. Activists accomplish this strategy by selectively using phrases that appeal to these institutions. Specifically, a 1-standard-deviation increase in target ownership by a fund family, which is approximately 0.63 percentage points relative to an average of 0.09%, is associated with about a 0.4- to 0.7-percentage-point increase in the attack text’s alignment with the fund family. The average alignment for a fund family owning ten percent of target shares is 65%, compared to 46% for a fund family with less than 0.01 percent target shares. The increase in support is economically substantial and suggests that activists write their communications to solicit support from larger shareholders.

Is it effective?

The fund family, to whom the attack is well aligned, tends to pay more attention to the attack and vote in favor of the activist. An attack that is well-aligned with larger shareholders is also more likely to be successful. Compared to a dummy text, the average attack text garners 1.7 percentage point higher mutual fund support and is 9.8 percentage points more likely to culminate in a win for the activist.

The success of the strategy is shaping the interactions

Activists learn from their activism experience with fund families and employ the strategy of aligning attacks with larger shareholders better in subsequent attacks.

Compared to a dummy text, stitched sequentially from parts of all the attack texts, the actual attack text garners higher aggregate alignment. The difference is significant at 1%. The attacks have become more aligned with the shareholders over the sample period. On average, the attack text garners 53% aggregate alignment, compared to 28% for the dummy text. The 25 percentage points increase in aggregate alignment is associated with 9.4 percentage points higher probability of activist’s succeeding or settling the attack.

Conclusion

I find that activists, in proxy communications, use phrases to align attack text with fund families that own a larger share in the targeted firm. The fund family, to whom the attack is well aligned, tends to pay more attention to the attack and vote in favor of the activist. An attack that is well-aligned with larger shareholders is also more likely to be successful. My findings suggest that activism functions as a vessel for shareholders’ implicit preferences, pushing their agendas. The result echoes the concern that few shareholders wield disproportionate power over the direction of corporate America.

Although I validate my findings based on proxy guidelines texts, a non-machine learning-based approach, and differing parameters, I lack counterfactual data. Future research that assesses exogenous shocks to the interactions between parties and other modes of communication could shed more light on ways persuasion plays out in shareholder activism.

Scroll to top

Scroll to top