Manish Jha

I am an Assistant Professor of Finance at Georgia State University.

I hold a Ph.D. in Finance from Washington University and a Bachelor's degree in Technology from IIT Kanpur.

Prior to my doctoral studies, I worked in sovereign bond research and options trading. I am deeply grateful for the support from

Human Resource India,

Kendriya Vidyalaya,

MPS Foundation, and

Super30.

Feel free to reach out to me at mjha@gsu.edu,

or connect with me on

BlueSky,

LinkedIn, and

Twitter/X. Thanks for stopping by!

What's New?

I’ll be at Florida State Univesity for Fall seminar, please reach out if you’d like to connect while I’m there.

Research

Research Interests

Artificial Intelligence, Corporate Governance, Financial Technology, Machine Learning, Text Analysis

Working/Revision Papers

4. The Politicization of Social Responsibility

Institutions support for socially responsible proposals varies based on state politics (donkey-elephant).

3. ChatGPT and Corporate Policies

arXiv, NBER, SSRN, Video | Becker Friedman, Chicago Booth Review, Harvard CorpGov, VoxEU

Finalist for John L. Weinberg/IRRCi Best Paper Award 2024

Second Place Dr. Richard A. Crowell Memorial Prize 2023

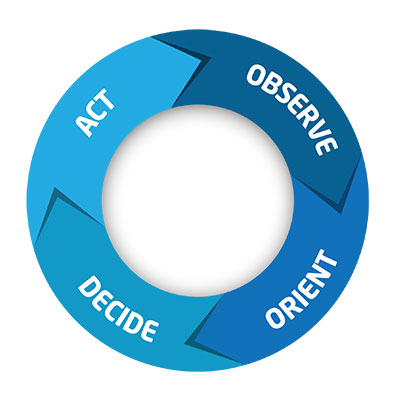

ChatGPT could predict corporate policies, sometimes better than the market and forecasters.

2. Generative AI, Managerial Expectations, and Economic Activity

arXiv, SSRN, Video | Chicago Booth Review, GSU News

1. ESG Metrics in Executive Compensation: a Multitasking Approach

ESG metrics in compensation contracts are accompanied with lower performance sensitivity for financial metrics.

Published/ Accepted Papers

4. Does Finance Benefit Society? A Language Embedding Approach

Capitalist countries (bull) discuss finance in a more positive context.

3. A Shared Interest: Do Bonds Strengthen Equity Monitoring?

Institutions monitors firms more when it holds firms' bonds (sitting on bond papers).

1. Natural Disaster Effects on Popular Sentiment Toward Finance

People have negative sentiment towards finance (bank) after uninsured disasters.

Teaching

Georgia State University

Washington University in St Louis

Resources

Data

Conferences

Miscellaneous

Press

NBER, October 4, 2024 [PDF]

Centre for Economic Policy Research VoxEU, September 30, 2024 [PDF]

Harvard Corporate Governance Forum, September 4, 2024 [PDF]

Georgia State News Hub, Ground News, MSN.com, Phys.org, January 13, 2025 [PDF]

ZanistaAI, November 18, 2024 [PDF]

Chicago Booth Review Fall 2024 Magazine, September 21, 2024 [PDF]

Law and Technology Resources for Legal Professionals, February 29, 2024 [PDF]

AI Journal, Business Wire, PanAgora, Yahoo Singapore, February 27, 2024 [PDF]

NBER, October 4, 2024 [PDF]

Chicago Booth Promarket, May 10, 2023 [PDF]

Chicago Booth Promarket, December 16, 2020 [PDF]

Bloomberg Opinion, Washington Post, August 10, 2020 [PDF]